The real issue of Pakistan is not the lack of resources but of their mismanagement and misplaced priorities. The sky high election campaign sloganeering, budget figures, ground realities and effusive claims of the politicians have no symmetry. Masses always stick to many hopes but they all despair when the budget is announced. It is always poor’s slayer and rich’s affable. Earlier we had annual budgets based on shrewd planning but unfortunately now we have quarterly budgets because of ill-vision and a hell of incompetency. Forlornly, Pakistan is the victim of economic, social, political, religious and cultural mis-governance. It strongly needs a systematic and structural overhauling. Articles 3 and 38 of the Constitution-1973 state ‘each according to his ability, to each according to his work’ and promotion of social and economic wellbeing of the people irrespective of sex, caste, creed or race’ respectively, does our budget takes into account these articles? Annual Budget being the most powerful fiscal instrument determines the length of progress and recession of a country. Annual Budget 2015-16 in Pakistan is imminent that will probably be announced on 19th of May. Estimated receipts are 3000 billion rupees whereas the expected borrowings click to 1500 billion rupees.

Total GDP of our country is around $245 billion of which 4.8% can be taken as debt for deficit budgeting but it always exceeds. In our annual budget of 3945 billion rupees for 2014-15, 1325 billion rupees have been fixed for debt servicing, 700 billion rupees are allocated for defence (it is other than pensions of the retired military men and military procurements from abroad), 291billion rupees are reserved for the luxury spending of the federal government, 574 billion rupees are named as so called transfers, grants and subsidies, and just 525 billion rupees are given to Public Sector Development Program (PSDP). Even in the PSDP allocation, most of the fund is going to be spent on water and energy projects and least is left for health and education that are directly related to the public. In the ongoing budget year, total development budget of AJK is 11 billion rupees, of GB is 9 billion rupees, of Baluchistan is 50 billion rupees whereas of Metro Bus Project Lahore was 1.5 Billion USD in 2013, of Ring Road Lahore is said 100 billion rupees and of Metro Bus Project Rawalpindi is 60 billion rupees. Total budget of three projects is 310 billion rupees whereas of 55 % of Pakistani land including AJK, GB and Baluchistan is just 70 billion rupees. Ever ignored and deprived Southern Punjab has no due allocation as it seems the step progeny. The legitimacy, far sightedness and competence of the government are thus questionable. By the way is not metro bus a PSE? The movements do not start on their own; they have always reasons behind i.e. exploitations, deprivations.

Government of the Punjab has waived off bed tax commonly known as hotel tax in the whole province but the hotel businesses have not lessened staying charges instead have increased manifolds. Reportedly, it is because the family members of the present government in the province have taken this business under their umbrella. Taking Murree as instance, this tehsil used to generates more than 50 million rupees as hotel tax annually before annulment. What about rest of around 150 tehsils of the province? Do PC hotel, Avari hotel and countless others qualify to be exempted from tax? Hats off to the previous PM Shoukat Aziz who abolished wealth tax in 2002 just to save his own property from tax. Federal government has levied 17% as sales tax in the federal capital but unfortunately the Chief Commissioner Islamabad has no time to consider the importance of the matter to charge sales tax at 17 % to equate with the tax rate charge by FBR as in ICT tax rate is still of previous year’s rate that is 16%. It is very unjust that agriculture sector which is 21 % of the GDP contributes 0.22 % to the exchequer as direct taxes. The agriculture income of the Punjab government was just 0.830 million rupees and of Sindh 0.426 billion rupees during 2013-14. Why landlords and feuds are tax exempted? Why luxury vehicles i.e. above 1800 cc are least taxed only because they belong to the upper class?

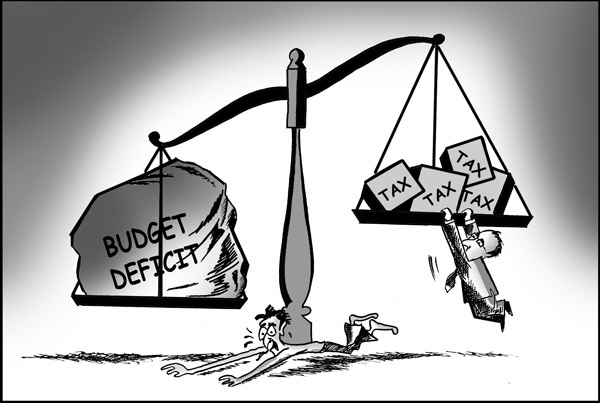

Budget is composed of governmental receipts and expenditures. There are three basic heads of expenditure generally known as 3D; debt, defence and development. Receipts are collected through taxes, remittances and loans etc. How to meet the budget deficit? Government must lower down its expenditure. In the incumbent budget, federal government has reserved 291 billion rupees for its personal expenditure. It can easily reduce them if it takes economic measures and adopts frugality and austerity. Lavish expenditure spent on incompetent and gluttony ministries and foreign tours ought to be cut down. Bailout packages given on Public Sector Enterprises like Pakistan Steel Mill, Pakistan Railway and PIA etc should be abolished and instead of packages their management should be made effective and efficient. Privatization is no solution as it is just one time’s income. Calculatedly, it furnishes more loss than benefit in the long run. Tax evasion and frauds must be controlled by synchronization of the public and taxpayers records. CNIC number of every person should be made the NTN of that person. It will help in identifying the looters and evaders. Tax net and base both must be broadened and other taxes like carbon tax, tax on services, agriculture tax and tax on wealth like shares of stock exchange and properties should be charged increasing the tax to GDP ratio as well. Income tax is charged on services sector which accounts for around 54% of the GDP but no services tax is taken. If the government charges tax on the services of a poor juice seller why can’t it levy tax on the services of doctors, engineers, consultants and lawyers etc? Local government system must be made fully functional to reduce administrative costs, to fulfil the spirit of real democracy and to develop the populace at core level.

Under Balance of Payment, government should enhance the tapping of its natural resources to ease the current account balance. It should increase its exports and FDI by alleviating water and energy crises and overcoming security threats as well it must minimize the imports especially of the luxury items. By well managing the resources, the gulf between imports and exports must be bridged to balance the balance of payment and trade. Agriculture tax which is levied with a ratio of 5% since 2001 must be revised and be made equal to sales tax rate. Pakistan faces a huge corruption which amounts 500-700 billion rupees annually. It must be controlled and the culprits be surely punished with iron hand. Electric and gas thefts have augmented but the dirty hands are reluctant to scuff. They must be halted in any case. India has recently tabled Undisclosed Foreign Income and Assets (Imposition of Tax) Bill, 2015 in its parliament. It is aimed at netting billions of dollars of undisclosed incomes parked on alien lands. Reportedly, more than $200 billion of Pakistani politicians, business tycoons, military men, bureaucrats, models and religious pundits are parked on alien lands. There must have a legislation to at least bring them back. We need to stabilize our currency, to control inflation and to curb the business of money laundering. It is hard to cut defence expenditure and debt servicing but we can indubitably reduce further debt taking. All the non custom paid vehicles should be registered which will generate billions of rupees. Government has spent around 500 billion rupees to pay circular debt but the issue of energy crisis seems more severe. PM Youth Loan Scheme is proved of no gain. The coming budget must be aimed at the socio-economic wellbeing of the masses as enshrined in the constitution instead of meeting the voracious political interests and screening puzzled figures.